Vitalik Buterin is the Co-Founder of Ethereum. Ethereum is a programmable blockchain hosting decentralized applications in finance, governance, gaming, and digital art and collectibles. Ethereum's native cryptocurrency, ether, follows bitcoin as the second most valuable cryptocurrency by market capitalization.

In Part 2, Buterin discusses regulation by the US Congress and Securities and Exchange Commission, decentralized autonomous organizations, and governance in a decentralized world. Click here to read Part 1, where Buterin discusses whether cryptocurrencies will replace fiat currencies, the potential impact of decentralized finance, whether or not crypto will decrease inequality, and his favorite NFTs.

Crypto made a big splash in Washington in the Senate with this August’s infrastructure bill, from which there was considerable drama and controversy. What were your main takeaways from those events, and how do you think members of the Ethereum community should go about engaging with and educating lawmakers?

There's a lot of misunderstanding about the different parts of crypto, how those parts of crypto work, and what they do. One of the situations that created a big controversy was that they (lawmakers in the US Senate) tried to add in this piece of legislation to improve tax compliance in the crypto space. But instead of targeting things that are actually brokers, like Coinbase, which publicly said that it welcomes this kind of regulation and is ready to comply with it, the lawmakers’ legislation ended up targeting a whole bunch of actors in the crypto space that have no ability to get information about what transactions they're processing.

When you upload your code to GitHub, they don't have any technical ability to figure out what is the human or economic purpose of a piece of code that's being uploaded. In that same way, miners and proof-of-stake validators don't have the ability to get the information about what these smart contracts are doing that's relevant from a tax perspective. But the law would have ended up technically forcing them to try to do that, which of course in practice would have meant that this entire sub industry of miners or validators would have had to either go underground or move to other countries.

I don't think that’s the effect that the lawmakers wanted. At one point, they even ended up trying to make an exemption for proof-of-work miners, but not proof-of-stake validators, which is something that ended up puzzling and upsetting a lot of people. In the Ethereum space, we're very proud of the fact that we have this transition from proof-of-work to proof-of-stake that's at this point more than 90 percent completed, months away from launch. Proof-of-work does cause a lot of environmental problems and the switch to proof-of-stake does completely remove that issue. Why should the Ethereum space be hit by this regulatory move that basically exempts proof-of-work systems but not proof-of-stake systems?

Eventually, even that amendment ended up adding proof-of-stake as well, and now of course the negotiations over that bill are continuing to happen. It still has to go through the House and all those things.

There's a need for regulators to understand the different actors in the crypto space better, and also for people in the crypto space that are talking to regulators to understand what it is that regulators are looking for more clearly. I'm hopeful that what happened was a bit of a wake-up-call to all sides, and things are going to be more cooperative going forward. On both sides, I think there's things that the crypto space can do to be more cooperative as well, but we'll see how that goes.

Gary Gensler, the Head of the United States Securities and Exchange Commission, remarked that he believed nearly all initial coin offerings — presumably including ERC-20 tokens — were securities and should be regulated as such. Do you think this is a fair assessment?

It's definitely not true that all of the ERC-20 launches are securities because there's ERC-20s of different kinds. At the very least, USDC is definitely not a security. You do have to ultimately look at the purpose and function of the token, what particular role they have, and what sort of financial role they have. To what extent is there a particular team that's actively promoting and getting ends, potentially getting a lot of money from promoting it and all of these things? I do think he has a good point, in that there's a lot of projects that try to pretend that they're not securities, but actually they're totally securities. But at the same time it's definitely not true that all the projects are. Ultimately it does depend on every individual token. It's hard to make those very global judgments about things.

A common criticism of crypto is that it is mainly used by criminals: namely drug dealers, terrorists, etc. These concerns seem to skyrocket after events like the Colonial Pipeline or JBL Meatpacking facility ransomware hack, or even the recent PolyNetwork hack. Do you think that the pseudo-anonymous nature of ether will meaningfully change the balance of power between law enforcement and criminals?

Lots of things change the balance of power between law enforcement and criminals all the time. Sometimes you get technology that makes it easier for people to hide, and that ends up getting used by many more people than just the criminals. In the wake of Afghanistan, where a group of people who were formerly considered criminals have now become the government, people now have the need to hide from them. Most people, including policymakers, would be very sympathetic to technology that helps them hide. But in general, there's technological changes that go in both directions all the time.

Another example might be that in-person surveillance just continues to be easier than ever, and over the last couple of decades we've massively moved to having far more cameras everywhere on the streets and having AI that's able to identify people. This is a natural technological back and forth that goes in all directions all the time.

The extent to which cryptocurrency in particular ends up enabling all of these illicit activities does get overstated. This sort of stuff happens with fiat currencies as well. Especially for professional groups, there's definitely ways to evade detection for whatever you're doing with fiat currencies, whether it's with cash or with some other mechanism.

Also, these groups end up relying on a lot of infrastructure other than cryptocurrency. A lot of the ways in which these groups get caught often end up being technologically independent. Good old-fashioned investigation, sometimes people within the organizations provide the information voluntarily, and that's something that can be done with communication, but can also be done with even the most anonymous cryptocurrency. There is a way for people to reveal their public keys, and then show, “Hey, these are the exact transactions and whatever was wrong either I wasn't part of it or here's what happened to me and this is my part of that trail.” It's much more complicated and nuanced than saying one particular technology is responsible.

Another thing that is responsible is the United States, and most countries, spend far less effort than they should on plain old cybersecurity. All these platforms end up being trivially hackable. But at the end of the day, if they're not hacked by ransomware people today, if the United States ever enters into a proper cyber war with Russia or China, then they're definitely going to be hacked and they're going to be broken very easily. Focusing on going after specific attackers is not even the best approach because it ignores how many of these different attackers are there. That's something that I generally think governments should be putting more resources into.

Looking at hacks within the cryptocurrency space itself, like PolyNetwork type things, I think the experience of the crypto space already shows that improvements in those areas are possible. If you go back to 2014, for example, where you had the Mt. Gox hack and where you had all of these crazy exchange hacks, in the Mt. Gox hack half a billion dollars went poof at a time when half a billion dollars was a big part of the entire crypto space. And now, the hacks are about the same size as they were before, but in the context of a crypto space 100 times bigger.

There were actual improvements in security, like exchanges got much better at being secure with managing their funds. The DAO got hacked in 2016, and that was before security auditing was really a thing. And then, after that, security auditing is very much a thing and the result is a complex set of tools and processes that ends up catching most of those issues. On the whole, the crypto space has successfully managed to become considerably safer than it was a few years ago. This kind of approach where instead of focusing on trying to rat out every single attacker you focus on making systems themselves inherently more robust is something that's already having a lot of successes and it could have more successes.

Recently, there’s been some buzz around Decentralized Autonomous Organizations, or DAOs, most of which are built on Ethereum. What are these, and what use cases might they have? What legal frameworks should DAOs exist in?

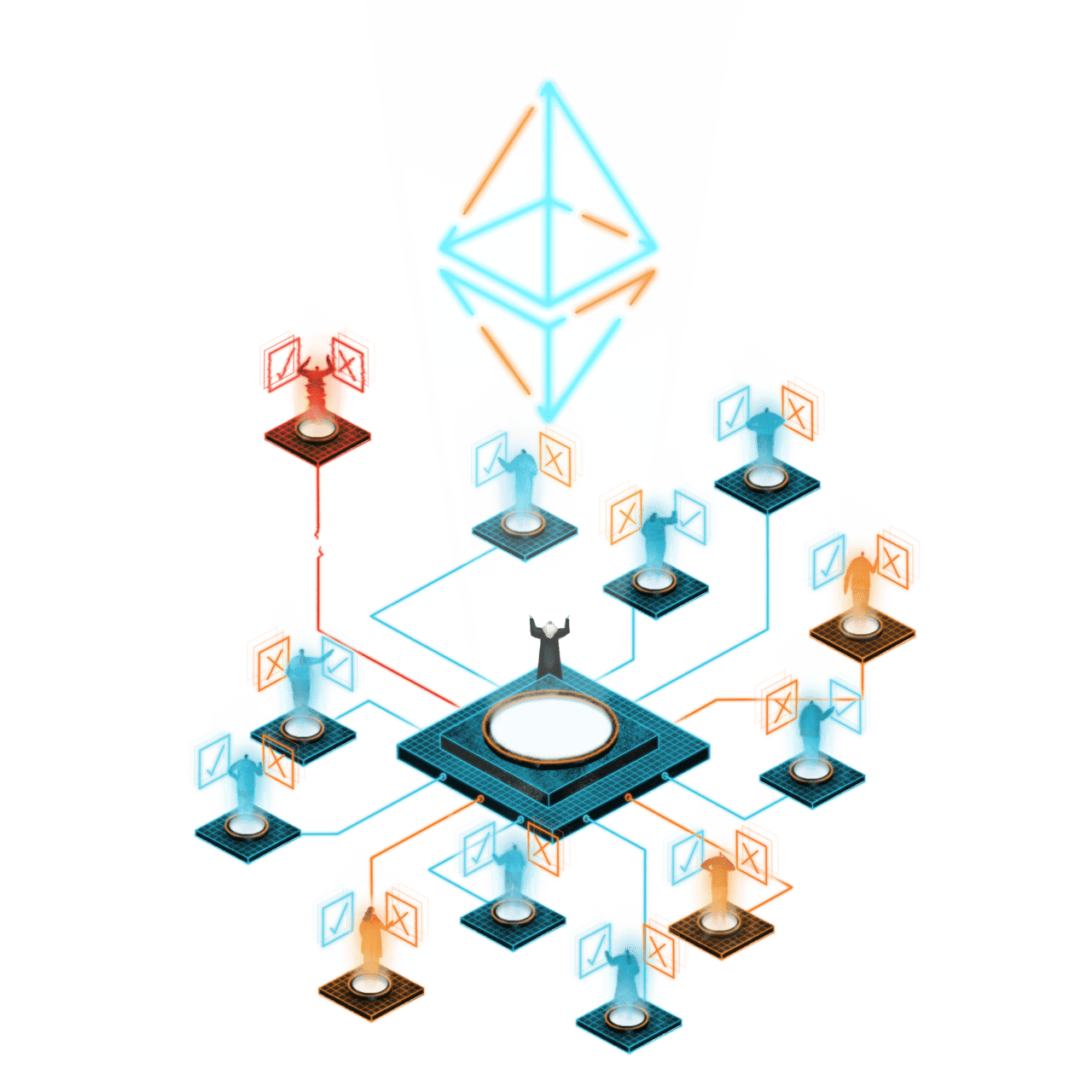

A DAO is a system of smart contracts, or one smart contract, so a computer program running on Ethereum directly controls either assets or something that the outside world cares about. The point of the smart contract is to implement some kind of set of rules by which a large group of people are going to collectively exercise control over those assets.

There's actually a couple of these. There's these charity DAOs where you have a pool of funds, a large group of people that are members of the DAO, and then they vote on where the funds get allocated to. Sometimes, you have DAOs that are managing DeFi projects. For example, there is the Uniswap DAO that manages the ability to allocate Uniswap tokens. It allocates Uniswap tokens in order to fund people doing things that are improving the Uniswap platform. The Uniswap ecosystem can exist and can keep developing things without Uniswap, the company, needing to exist in the future.

DAOs also get used for all sorts of random projects, I know that there's even meetups that are governed by a DAO. So a DAO ends up deciding where they're hosted, who is an organizer at some point, and all those things. It's just a way to have clubs of people. This common decision making structure, and what that decision making structure ends up controlling, is pretty much anything that a blockchain can control, or even things outside of the blockchain if people are willing to pay attention to the results and honor what the results are.

DAOs are interesting because they're a better alternative to a lot of existing governance software because of how open ended they are. Even this concept of a large group of people being able to control money without having to trust the treasurer, that's something that the existing financial system doesn't really make easy. You can even set up arbitrary rules, like you can say the ability to change the protocol’s rules is controlled by a DAO, but whatever decisions the DAO makes, they only take effect after two months. So even if the DAO makes some bad decision, users have a lot of time to leave and move to a different platform. There's a lot of these different things DAOs can be useful for as far as legal structure goes. It really depends on what the DAO is trying to do.

Right now, DAOs tend to mostly be controlling either things within the crypto space, or fairly small things. If things inside of the DAO go wrong, there isn't really that bad of a consequence. People will realize that it went wrong. If a DAO controls a meet up for example, and someone does some kind of hostile takeover of the governance within the DAO and they control the meetup DAO now, everyone's going to know that that happened. Someone else is going to very easily have the ability to say, “Hey, I'm just gonna fork the meetup and I'm gonna set up a competing one. I'm gonna have my own DAO with better rules, and you can switch to mine instead.” So far, DAOs have been used more for those kinds of things.

If DAOs end up being used for serious things like a condominium association (the owners of apartments in the same building), they could govern what maintenance fees get used for, when the apartment gets sold, or whatever. If people start using DAOs for those kinds of things, then obviously you need legal reforms to make it possible to use DAOs for those things. That's a challenge, figuring out exactly what structure makes sense. I know there's a lot of good work being done in Wyoming, in places like that. I'm not personally too familiar with the exact details of how those laws work, but I do know that there's a lot of progress being made. This is all still in a fairly experimental stage at the moment.

A key value to Ethereum is decentralization. But having a blockchain be decentralized and rapidly evolving is not the easiest pairing. What does Ethereum governance look like now, and how do you hope it evolves in the future?

In the way that Ethereum governance works now, it's this fairly multi-stage process. The EIP-1559 change, that's a good example of something that happened very recently. It's something that a lot of people have strong opinions on. First, it gets proposed, and when it gets proposed there's often several rounds of informal proposal and informal discussion. That happens on Ether Research Forum, community discord chats, telegram chats, and sometimes in person conferences. Then, once the proposal is developed enough, someone makes up a formal proposal. This is called an EIP, an Ethereum Improvement Proposal, and the purpose of an EIP is to fully formally specify how the EIP works. It needs to be precise enough that an Ethereum client developer can read the EIP, and if there’s multiple client developers, they can read the EIP, they can separately implement it, and they can have implementations that are compatible with each other. But there is this EIP, it gets proposed. Then, usually what happens is that there's the regular track, and the regular track is that there are these biweekly meetings between core developers. There are these all-core devs calls, and eventually someone champions that EIP in the all-core devs call. Then, there is this rough consensus where if there is broad agreement that an EIP should be implemented, and should be included into a particular hard fork, then that EIP is agreed on and the EIP is implemented by the different Ethereum client developers.

There's actually more than one implementation of the Ethereum protocol, there's about four or five of them right now. So it gets implemented by all of them, and then it gets agreed on at what block number that change takes effect. And then the code with those changes gets uploaded, then people download it and the change happens. So that's the normal track.

Then there is the question of what happens if people disagree. Generally, if people within the core developer circles disagree, if there's more than a tiny disagreement within the core dev circles, then usually the proposal doesn't go through all core devs. It often either gets ignored or it gets modified until it does.

If people outside of the core dev group within the community disagree, then they often shout out and say so. If that happens, then often there's at least some core developers that listen to the community and say, “Hey if the community doesn't want this proposal, then we're not going to try to push it through.” And it doesn't happen. Realistically, if the community was opposed to something, and the core devs were really intent on pushing it through, then what would happen is that there would be some team that maintains a version of the Ethereum software that does not incorporate those changes. And then, in the extreme case, there could even be a fork: there would be some parts of the network that adopt those changes and some parts of the network that don't adopt those changes. The system splits in half and you have two Ethereums. That's what actually happened with the DAO fork back in 2016. But because people know that if the community is unhappy with the developers of this they have this nuclear option, the core developers generally don't want to implement things that go against the community's wishes. It ends up being in practice very stable.

In the case of EIP-1559, what actually happened was that it was the opposite scenario: there were a lot of people in the community that were very enthusiastic about it. But at the beginning especially, a lot of core developers were just not very interested. What happened was that the community members made these very big public shows of support. There is this platform in Ethereum called Gitcoin grants, which is there for funding projects that are considered by the community to be valuable to the Ethereum ecosystem. The supporters of EIP-1559 came together and through Gitcoin they donated a huge amount of money to the EIP-1559 implementation fund. The implementation fund got more money during that round than almost every other project combined, and this was this very strong signal that, “Hey guys, the community really values this.” It both paid for implementation, which is important because core devs are generally more willing to consider helping if there already is an implementation because that means they don't have to do as much work. And also it was just proof to them that the community considers this as something really important. Then it proceeded from there and there were a lot of rounds of essaying and economic analysis and refinements. A year later, that ended up getting in.

Lately, you’ve mentioned some caution toward Ethereum becoming too US-centric, advocating for diversifying the Ethereum community and its development. Could you expand on that line of thought and offer some ideas for how to make Ethereum increasingly global?

Being global is one of the really important advantages of the crypto space. It's one of the very few areas where you have people from the United States, people from Europe, people from China, people from Latin America, and they’re all participating in the same project. It happens to a much greater extent in the crypto space than in most other places, and it's really amazing for giving people the ability to participate in this global space. It also ensures there's parts of the crypto space that actually understand the needs of people in a whole bunch of different contexts.

You often get these very different flavors of applications, depending on what kind of community it's in. In the United States, there's a huge amount of internal diversity, but one of the things that does end up getting emphasized a lot from the “New York DeFi crowd” is financial projects that focus on the needs of people that already have a lot of money and are just figuring out how to slosh that money around more efficiently. But if you go and look at Latin American projects, a lot of them are about digital democracy and blockchain Universal Basic Incomes (UBIs) and those kinds of things. You end up getting a very different emphasis. Going into Europe, you see very different kinds of projects. In other parts of the world, you see different kinds of projects as well.

The Ethereum ecosystem really benefits from the extent to which it has a global focus already, but that's something that does need to be actively maintained because it is very easy to naturally fall into having a particular center of gravity. Once you do that, it's very difficult to get back out. What happens is that it's very easy to be part of the in-crowd if you're already in the in-crowd. But if you're not in the in-crowd, especially if your English is not great, then it’s very hard to break into and feel like you're a part of that community. Whereas if there's these different bubbles, then it reduces the extent to which being part of the in-crowd matters because the community builds itself around the understanding that there are more people that are not part of the in-crowd and you have to maintain communication with all of them.

In terms of what we can do better, one of the things that we already do is the Ethereum Foundation holds a developer conference (dev con) in a different continent every year. So far, we've had two in Europe, two in East Asia, one in Mexico, and the next one that we're planning for right now is in Colombia. Then we’re exploring places in Africa and other parts of the world in the future as well. There's all of these different kinds of online events. There's making sure that all the different materials get translated into all these different languages. All of the things that we do already, we still can easily do much more on, like we can do much more on explicitly highlighting what different members of the community in different parts of the world are doing. Even just educating people in different Ethereum circles about what each other are up to. There's more active efforts to help people who are starting to become developers and forming developer ecosystems in those places.

There's a lot of things that can be done better, but it is definitely something that's important to do because if you don't do it then you risk having a culture that dominates around one particular type of person. Then you end up creating something that helps people move US$40 billion around more efficiently, but otherwise what's the point. That's not something that I really want personally.

Apostolicas and Nayar spoke with Vitalik Buterin via Zoom on September 2, 2021. This interview has been lightly edited for length and clarity. Apostolicas owns various cryptocurrencies, including ether.